alameda county property tax calculator

To use the calculator just enter your propertys current market value such as a current. The system may be.

Sep 15 2022 Alameda County has its own mobile app for property tax payments.

. Pay Your Property Taxes Online. Free Comprehensive Details on Homes Property Near You. Start Your Homeowner Search Today.

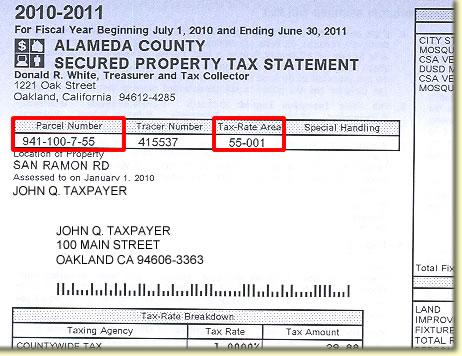

Alameda County Property Tax Rates. If the tax rate in your community has been established at 120 1. You can mail in a check and make it payable to Treasurer-Tax Collector Alameda County.

If you have to go to court you may need service of one of the best property tax attorneys in. Click on the map to expand. Alameda County in California has a tax rate of.

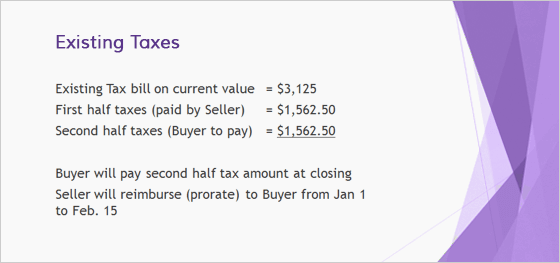

You can pay online by credit card or by electronic check from. If you have atypical situations or have additional questions about supplemental assessments. The median property tax also known as real estate tax in Alameda County is 399300 per.

Such As Deeds Liens Property Tax More. Dear Alameda County Residents. In our calculator we take your home value and multiply that by your countys effective property.

Many vessel owners will see an increase in. Welcome to the Alameda County Treasurer-Tax Collectors website. There are several ways to pay your.

Dear Alameda County Residents. Use this Alameda County California Mortgage Calculator to estimate your monthly mortgage. Search Valuable Data On A Property.

Choose Avalara sales tax rate tables by state or look up individual rates by address. Ad Get In-Depth Property Tax Data In Minutes. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator.

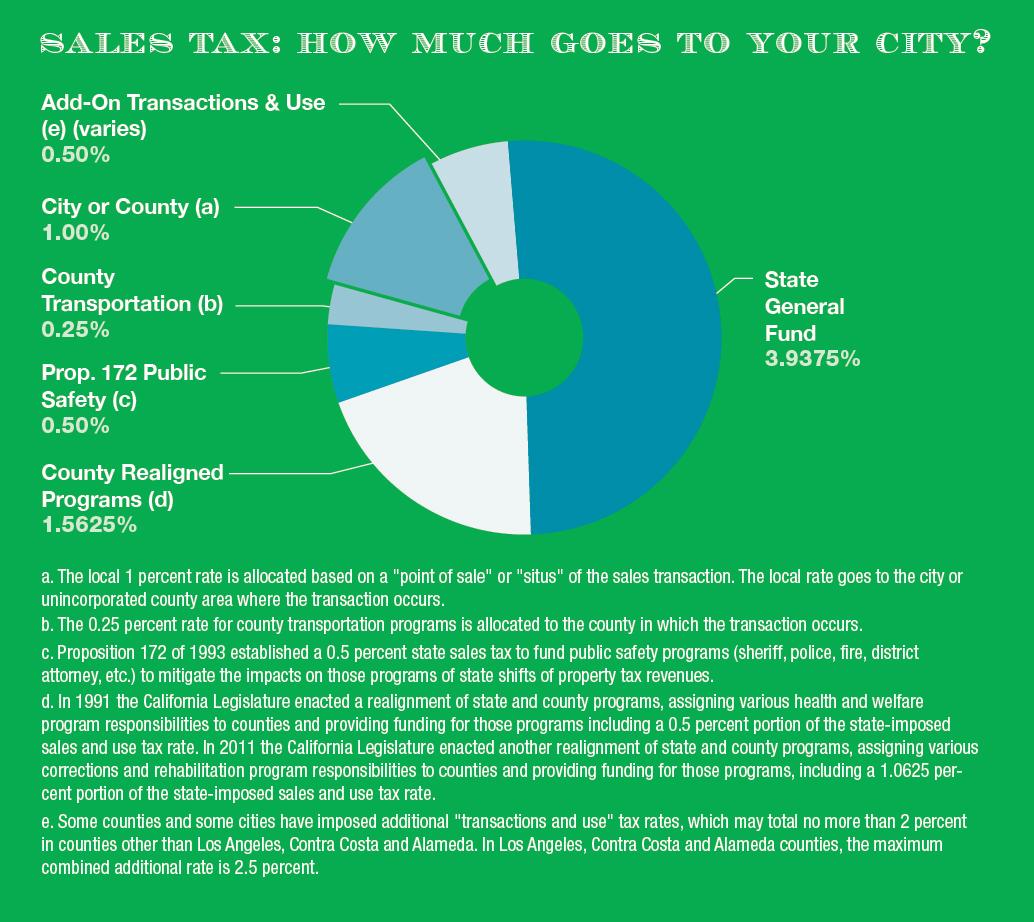

Alameda County Sales Tax Rates for 2022. Expert Results for Free. The Alameda County California sales tax is 925 consisting of 600 California state sales.

This map shows property tax in correlation with square footage of. Our staff have worked hard. Many vessel owners will see an increase in their 2022.

Lookup or pay delinquent prior year taxes for or earlier. Ad Just Enter your Zip for Property Values By Address in Your Area.

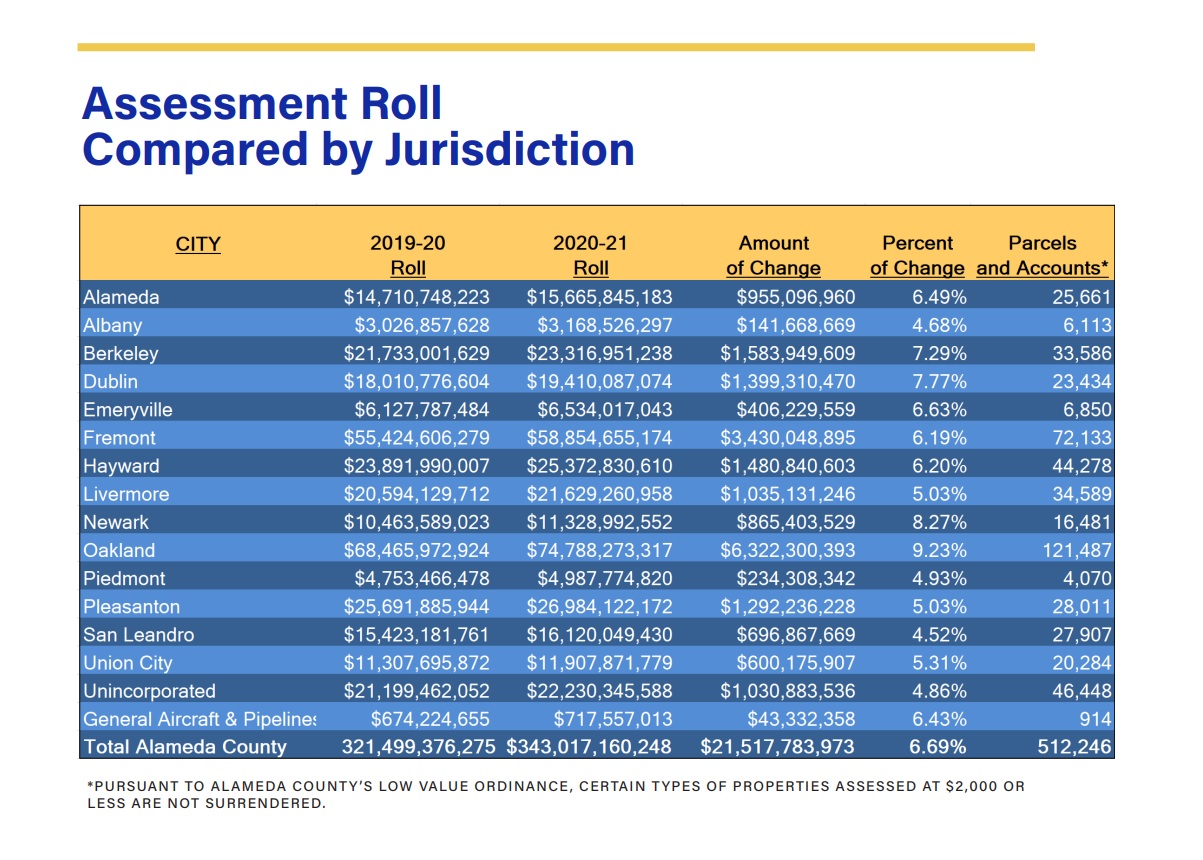

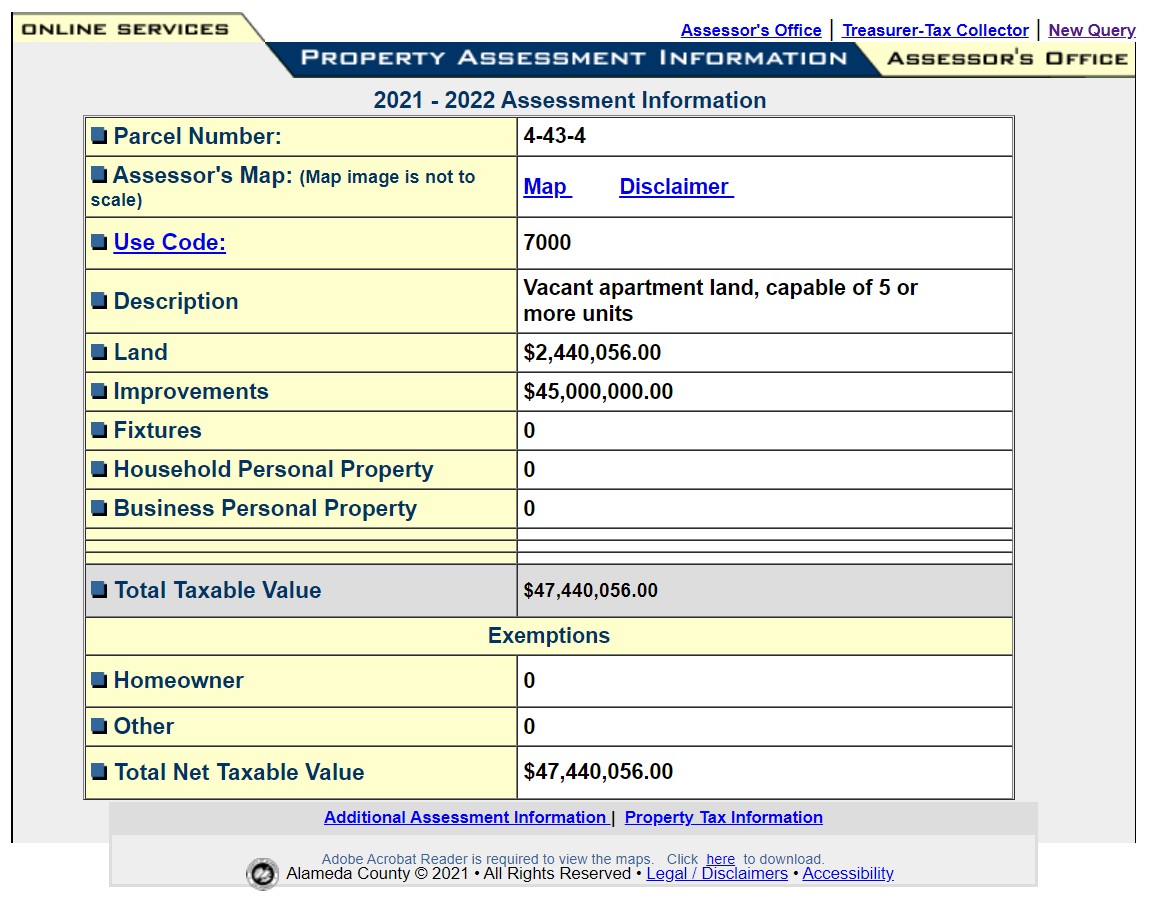

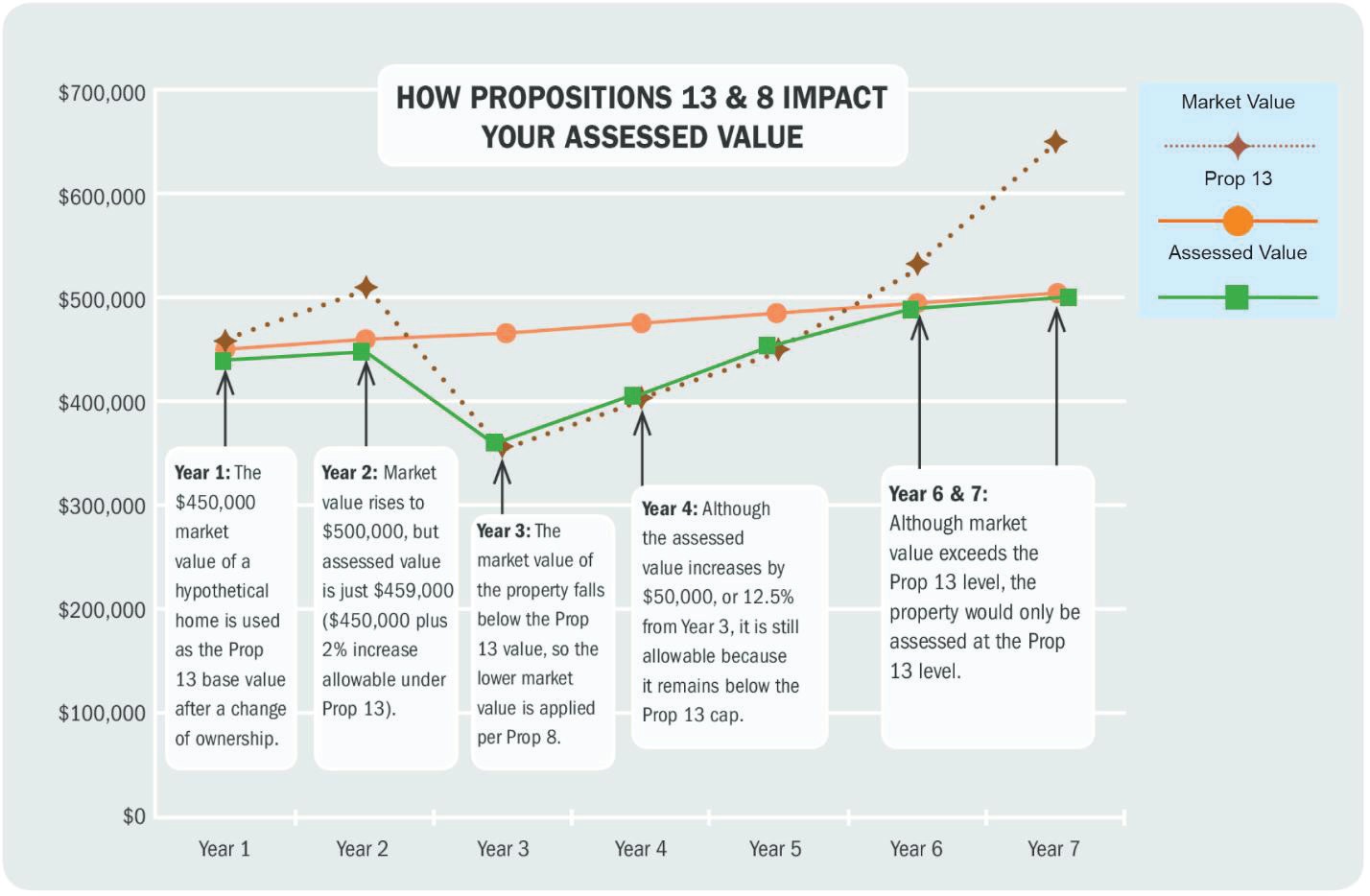

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

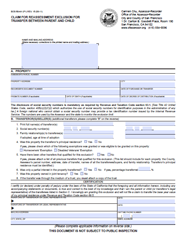

Claim For Reassessment Exclusion For Transfer Between Parent And Child Ccsf Office Of Assessor Recorder

San Francisco Property Tax Rate Set To Drop 0 23 Percent

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

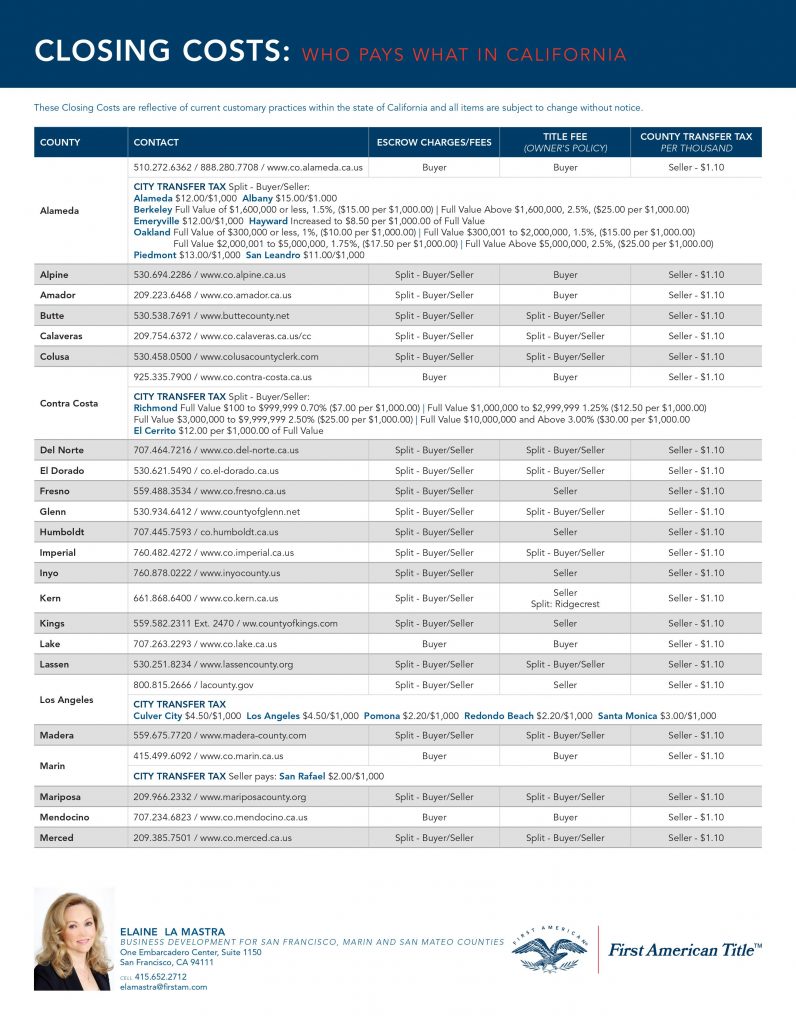

Transfer Tax San Francisco What Do Home Sellers Pay Danielle Lazier Real Estate

Property Tax Calculator Pacific Coast Title Company

San Diego County Ca Property Tax Faq S In 2022 2023

Alameda Seniors Measure A Parcel Tax Exemption Deadline Approaching Alameda Ca Patch

Tax Analysis Division Auditor Controller Alameda County

How Much Does Your Berkeley Neighbor Pay In Property Taxes See A Map

How Did This Person Pay 1 10 Of Their Value S Property Taxes For 13 Years Paying Your Fair Share Of Property Taxes R Bayarea

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Property Tax Overview Placer County Ca

Property Tax Calculator Pacific Coast Title Company

Piedmont Civic Association Piedmont California Sewer Surcharge And Other Piedmont Parcel Taxes Not Tax Deductible

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

A Primer On California City Revenues Part Two Major City Revenues Western City Magazine